By decision of 3 July 2014, case no. 5 K 40/14, the tax court Niedersachsen presented the ECJ with the question as to whether and, if so how, the correction of invoices does have retroactive effect…

Input VAT deduction: invoice correction with retroactive effect?

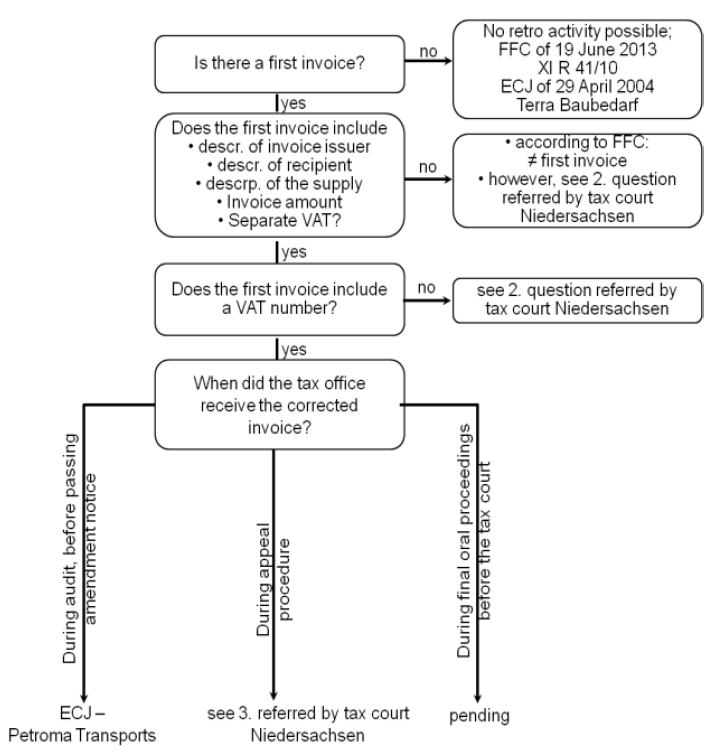

The tax court Niedersachsen referred to the ECJ the question of whether and, if so how, the correction of invoices can be carried out retroactively. If a VAT deduction is denied vis-à-vis the faulty invoice and is granted for the corrected invoice, it would be a “zero-sum game” if it were not for the additional late payment interest in the amount of 6%. However, interest payments would be omitted if a retroactive correction of the invoice was permitted.

By decision of 3 July 2014, case no. 5 K 40/14, the tax court Niedersachsen presented the ECJ with the question as to whether and, if so how, the correction of invoices does have retroactive effect. There can be no VAT deduction granted if there is no proper invoice. In this case, additional late payment interest, in the amount of 6%, are payable. However, interest payments would be omitted if a retroactive correction of the invoice was permitted.

1. Facts

An audit at a textile wholesaler queried the fact that, on some self-billing invoices, which serve as invoices, the VAT number of the supplier was missing. The textile wholesaler corrected the self-billing invoices during the course of the audit by adding the missing VAT number of the supplier. Nevertheless, the tax office did not allow the input VAT deduction on the grounds that the requirements for input VAT deduction were not fulfilled in the relevant years from 2009 to 2011. The tax office found that they were fulfilled only at the time the executed correction of the invoices occurred (in 2013).

It was only during the appeal procedure that it became clear there were no corrections of invoices made for 2008. This was done later during the appeal procedure in 2014.

2. Questions by the tax court Niedersachsen referred to the ECJ

The tax court Niedersachsen asked the ECJ to clarify the question of whether the findings, in legal case “Terra Baubedarf-Handel” (judgment of 29 April 2004 – legal case C-152/02), that input VAT deduction is only to be made at the time of issuing a proper invoice, may also be applicable in the case of adding missing information to the invoice or if retroactivity is permissible in such a case (see also the decisions by the ECJ regarding “Pannon Gép” and “Petroma Transports”, judgments of 15 July 2010 – legal case C-368/09 and of 8 May 2013 – legal case C-271/12).

If it is possible to correct invoices retroactively, the ECJ needs to clarify if there should be minimum requirements and, if so, what they should be regarding invoices that might be corrected retroactively. This is of particular importance in circumstances where the VAT number should have been stated in the previously issued original invoice.

It should also be determined whether the correction of the invoice is still made in good time if the corrections are being made during the appeal proceedings.

3. Practical tips

Incoming invoices should be examined to determine whether the necessary invoice information is stated.

- Check lists specifically designed for the company are essential.

- In the case of faulty incoming invoices, the recipient should immediately ask the issuer of the invoice to correct them.

- It is possible to withhold the remittance of the invoice amount until the corrected invoice is made available.

If an audit determines an incoming invoice to be faulty, the recipient should obtain the corrected invoice as soon as possible.

- The corrected invoice should be sent to the relevant tax office (and possibly also to the auditor) by the conclusion of the audit, at the latest.

- If the tax office denies the retroactivity of the invoice correction, an appeal should be raised against the VAT assessment on which the VAT deduction was denied. Even an application for suspension of operation should be considered. However, if suspension of operation is denied, late payment interest may arise.

- In view of the now pending preliminary ruling procedure before the ECJ, an application for the proceedings to be suspended should be filed.

- At the same time, an application for a VAT deduction, on the grounds of fairness, should be filed.

- The assessment period in which the corrected invoice was received should be kept open by means of a request for amendment or an appeal.

Dr. Oliver Zugmaier

Küffner Maunz Langer Zugmaier