Forthcoming conference

24 and 25 October 2024

Topic: VAT to the future

In the world of VAT, 2024 marks both the 70th anniversary of the very first adoption of the modern VAT system and the 30th anniversary of the foundation of the International VAT Association (“IVA”) in London. The theme for the conference is “VAT to the future”, looking back at the development of the tax over the last 30 years and looking forward at what the global VAT/GST/Indirect tax landscape could look like in the next 30 years. Looking at challenging areas such as simplification, sustainability, and technology (digitalisation).

Speakers for This Conference

Graduated from HEC in 1997 with a specialisation in Finances, Cyrille Konter started his career in Germany within various investment banks as structureur and seller of derivatives on action. In 2003, he returns to France to take over the business development of TEVEA RF Consulting SASU.

.

David Hummel is since October 2016 legal secretary (référendaire) at the European Court of Justice at the cabinet of advocate general Kokott.

Before (2013 – 2016) he represented several tax law chairs at the Universities of Münster, Trier, Leipzig and Hamburg. In mid-2017 the appointment as a Professor at the University of Leipzig took place. His academic career starts with the Study of Law at the University of Leipzig, a Graduation (Phd) as an assistant of Prof. Dr. Stadie with a VAT-Thesis in 2009 and a Habilitation in 2013 with the matter: „Rechtsformneutralität im Öffentlichen Recht“ (neutrality of legal forms in public law – venia legendi: public law, especially tax law and public economic law).

David Hummel is one of the authors of, inter alia, „Rau/Dürrwächter“ (commentary of the VAT-Law), „Kirchhof/Söhn/Mellinghoff“ (commentary of the income tax law) and “Hübschmann/Hepp/Spitaler” (commentary of the procedure tax law). Furthermore, he is engaged as a tutor in the field of European Tax Law and State Aid Law.

Donato Raponi has worked in the Ministry of Finance as a Tax Inspector from 1976 until 1979; and in the European Commission from 1979 until 2017. He is now an Independent Consultant dealing with indirect taxes.

He holds a Master degree in European Tax Law and Bachelor in Economics. He is honorary professor of European Tax Law at Brussels Business Management School. He is Co-Author of the book “Arriva l’euro” (Carmenta Editor) and numerous articles in tax matters.

Emmanuel is a French tax lawyer specializing exclusively in indirect taxes (VAT, Excise and Customs duties). After 10 years of experience at Price Waterhouse Tax and Legal and then Arthur Andersen International, he started his own consulting law firm in 2000. He has specifically built a significant experience in international supply chain structuring, ERP/SAP VAT implementations and multi-national advisory and compliance coordination. His main areas of activity are pharmaceuticals, energy utilities, aeronautics and chemicals. He is a partner of VAT Forum CV and regularly lectures at international VAT events.

Fabian Völkel is Founder and Managing Director of VAT4U. After legal studies in Münster, Düsseldorf, New York, and London, Fabian worked for 15 years in consultancy at Clifford Chance, KPMG, Ayming (Ex-Lowendalmasai) and TALA Consult before starting VAT4U. His professional focus is on cross-border VAT, combining operational aspects of VAT compliance and VAT recovery with IT technology. Fabian holds a Ph.D. from the University of Munster and an LL.M. (Tax) from the University of London.

Fabiola Annacondia is the editor of the International VAT Monitor and the EU VAT Compass book, and the cluster manager for the VAT courses offered by IBFD International Tax Training. Ms Annacondia holds a postgraduate degree in International Tax Law from Barcelona University, a postgraduate degree in Tax Law from the Argentine Social Museum University and studied Comparative Tax Policy and Administration at Harvard Kennedy School. She worked as a fiscal auditor (tax inspector) for 11 years with the Argentine tax authorities and teaches indirect taxation at the University of Buenos Aires.

Ms Annacondia works at the VAT Department of IBFD for the last 23 years. She lectures, publishes and speaks at VAT Conferences around the world regularly on a wide variety of VAT-related topics. She is a guest lecturer at several LLM’s programs around the globe. She is a member of the VAT Expert Group at the European Commission and of the Subcommittee on indirect taxation at the UN.

In recent years, she has presented at OECD global forums and workshops in China, South Korea, Japan, Australia, Saudi Arabia and Mexico.

Fernando Matesanz is the owner and Director of the firm named Spanish VAT Services Asesores SL. He Counts on more than 20 years of experience in providing advice in VAT.

He is an active Tax Lawyer, member of the Spanish Bar and a certified Tax Advisor.

Fernando began his carrier within the VAT Group of Ernst & Young. After that, he founded the firm Spanish VAT Services Asesores SL a firm exclusively working on international VAT matters and other Indirect taxes. Spanish VAT Services is currently the largest independent VAT services providers within the Spanish market.

Fernando is a Board Member of the IVA, a Member of the EU Commission´s VAT Expert Group and President of the Madrid VAT Forum Foundation.

Dr. George L. Salis is Chief Economist and Senior Tax Policy Director at Vertex. He is a recognized economist, lawyer, and tax professional with over 29 years of experience in international taxation, trade policy and tax regulation, and fiscal economics consulting. He is responsible for assessing macroeconomic conditions and fiscal, legal, trade, and development issues in countries and tracking and analyzing the rapid change in tax policies and regulations, inter-governmental organizations, and tax administrations worldwide. George is an experienced analyst and advisor to senior executives in global firms, intergovernmental organizations, and tax administrations on taxation and fiscal policy related to SUT, VAT, transfer pricing, tax treaties, EU tax law, and trade regulation.

Dr. Salis is an adjunct professor of tax law, risk analysis, and econometrics at Texas A&M University Law School, and has published many articles on international tax, fiscal economics, tax policy, and global trade and finance in professional publications. He is a contributing author to LexisNexis’ U.S. Transfer Pricing Guide, 4thEd, and other professional magazines and journals.

George holds an LLM (Honours) in international tax law, a PhD in international law and economic policy, and an SJD in Taxation from The University of Florida. He is the recipient of the Advanced Certificate in EU Law from the Academy of European Law, European University Institute in Florence, and the Executive Certificate in Economic Development from the Harvard Kennedy School of Government, George is a Certified Business Economist (CBE- NABE Charter).

Greg was called to the Bar in 1981. Between 1983 and 1987, Greg worked in the Solicitor’s Office of HM Customs and Excise. He returned to private practice in 1988 with a firm of solicitors now known as Hogan Lovells International. He was admitted as a solicitor in 1989 and became a partner in the tax group of the firm in 1993.

Greg was appointed as a salaried Judge of the Upper Tribunal, assigned to the Tax and Chancery Chamber, in February 2012 and regularly sat in the First-tier Tribunal as well. In October 2017, he became President of the Tax Chamber of the First-tier Tribunal.

Greg is also Senior Judicial Commissioner of the Judicial Appointments Commission.

Irmante is a Global Director of Tax at Duracell, a Berkshire Hathaway company. She dealt with tax aspects of transitioning from Duracell´s previous owner – Procter& Gamble- to Berkshire Hathaway and onwards took care of setting up and stabilizing International Tax function within the new global organization. She is responsible for all international taxes globally and all the relevant areas, such as tax advisory, compliance, technology and is involved in variety of cross functional projects impacting tax. In VAT area, Irmante led automation initiatives pioneering Tax engine globally, creating own multijurisdictional VAT Compliance Solution and set up Center of Excellence for indirect tax compliance with Duracell, who now manages VAT compliance and related advisory for Duracell entities across all continents.

A lawyer by education, Irmante started tax career at Deloitte´s Global Tax Centre in Brussels, and on assignment at Deloitte´s Global International Tax/ VAT practice in New York, where she worked for variety of large multinationals assisting with compliance, advisory, audits. She then moved to industry in Barcelona, Spain, to take care of Global Transaction Tax/ VAT/GST Planning and Strategy at Agilent Technologies, representing Tax function in variety of large projects including M&A activities, spin off of Keysight Technologies, handling various aspects concerning introduction/change of taxes across the globe, multiple ERP related projects, tax engine.

Patrice Pillet is the Head of Unit of the VAT Unit, in DG Taxud (European Commission). He is responsible for the development and implementation of EU VAT policy, and notably for the VAT in the digital age negotiations.

He was previously Head of DG TAXUD’s legal Unit and has also been Head of Sector responsible for VAT on electronic commerce (2008-1016). He has also previously been responsible for international affairs and technical assistance in the Customs Directorate of DG Taxud (2004-2008), as well as for fighting VAT fraud and promoting mutual assistance in tax matters (1998-2004).

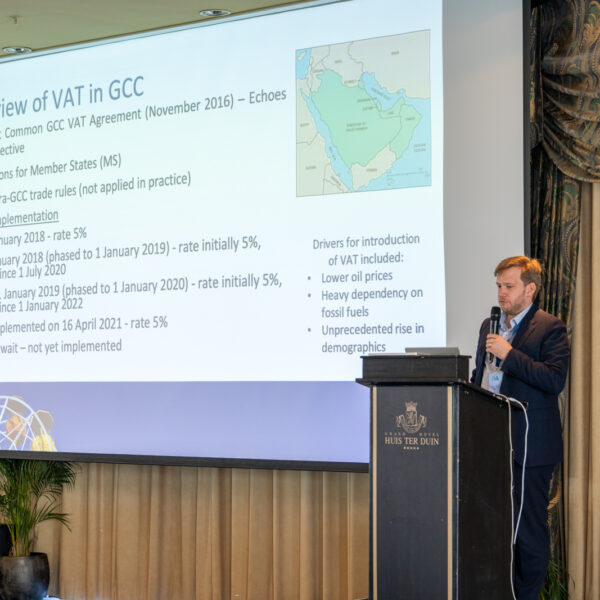

Is an international VAT consultant. He has worked since 1996 in international VAT for a Big Four and worked several years in industry as in-house VAT manager. In 2010 he started his own VAT consulting firm ALLVAT. He is frequent speaker at international seminars, organizes trainings for the Federation of Dutch exporters, the Chamber of Commerce, the International VAT Expert Academy (IVEA) and is partner of VAT Forum CV. He is currently a board member of the IVA and liaises with the IVA members outside the EU. His focus is on the international supply chain in Europe and more recently the GCC.

Ruth is an Associate specialising in indirect taxes with Hiller Hopkins LLP in the UK. In her VPG role, Ruth has worked closely with HM Revenue and Customs (“HMRC”) on the “Making Tax Digital” project, ensuring that HMRC is fully aware of the challenges faced by taxpayers unused to accounting software. She has also been working with HMRC on the legislation for a “No Deal” Brexit.

She also represents the VPG and the Institute of Chartered Accountants in England and Wales (“ICAEW”) on various committees with HMRC and was seconded to the Office of Tax Simplification for seven months in 2017 to look at ways of simplifying the VAT code in the United Kingdom.

Stephen Dale is a partner at Roosevelt Associés – accountants and has worked in French taxation for more than twenty years, having previously worked with PricewaterhouseCoopers in France and in the UK.

Stephen is a member (and former Chairman) of the FEE (Fédération des Experts Comptables Européens) Tax Policy Group and chair of the Institute of Chartered Accountants in England and Wales VAT Committee. He represents the IVA on the VAT Expert Group and is a member of the OECD’s Global VAT Forum.

He is a board member of the Association de la Pratique de la TVA européenne (APTE) and the Association des représentants fiscaux français.

He is the author of several publications such as the VAT Yearbook – Kluwer, VAT Guides – PwC, and for PKF, Articles – International Indirect Tax, BNA, journals and newspapers.

Thibauld MANSON is currently Tax Attaché for Germany, Austria and Switzerland at the French Embassy in Berlin.

Prior to his current position, he was head of the VAT Refund Unit for foreign businesses, international organizations and diplomatic missions at the French tax directorate for non-residents (DINR).

Thibauld attended the Ecole Normale Supérieure (ENS) de Cachan and holds a Master’s Degree in Management Science as well as 20 years of experience in both public and private sectors regarding economic and tax issues.

Conference Venue

Hilton London Tower Bridge

Address: 5 More London Pl, Tooley St, London SE1 2BY, United Kingdom

https://www.hilton.com/en/hotels/lontbhi-hilton-london-tower-bridge

Tel.: +44 20 3002 4300

Last conference

2024 Spring Conference

Düsseldorf, Germany

16 and 17 May 2024

Topic: Grit in the machine

VAT and GST are taxes on consumption and borne by final consumers. As these tax systems evolve globally, we are seeing more and more ‘Grit in the machine’ preventing these systems, for both administrations and taxpayers, from functioning smoothly and avoiding burdens on business and administrations. We will, in Düsseldorf, identify the ‘Grit in the machine’ and suggest solutions in relation to Fixed Establishments, Multiple Supplies, Import VAT and Customs requirements, Foreign VAT Refunds and Tax Technology’s supporting role in VAT Compliance, digital reporting and e-invoicing.

A very exciting set of sessions. See you there!

Speakers for This Conference

Annegret Rohloff is Team Leader – General Customs Legislation at the EU Commission, DG TAXUD (Taxation & Customs Union) in Brussels where her responsibilities include Cross-border E-commerce Legislation.

Previously she worked as Deputy Head of Administration at the World Customs Organisation, Policy Officer for Supply Chain Security at the EU Commission, German Customs Attaché in Washington DC, and Legal advisor in the German Customs Administration.

She is a Lawyer with a Doctoral Degree from the University of Konstanz, Germany.

I am a lawyer by profession. Since 2009, I have been working as the head of one of the divisions in the Bundeszentralamt für Steuern responsible for VAT refund in Germany. My work covers, in particular, policy issues, quality control and appeal procedures.

.

Ágnes Fekete is a Hungarian economist by profession. Since 2020, she is leading the sector responsible for e-commerce, import and export related VAT matters and derogations in the VAT unit of the European Commission. After working on the implementation of the VAT e-commerce package, currently she is busy with the VAT in the Digital Age proposal, and more specifically with the Single VAT Registration element of it, including the Import One-Stop Shop.

Prior to joining the indirect taxation unit, she worked on various customs projects in the Commission, including four years in the cabinet of Commissioner László Kovács.

Andrea is the Head of Tax (Direct & Indirect Tax) at Panasonic Industry Europe GmbH, based in Hamburg, Germany. She is an experienced in-house VAT professional and leads the VAT and direct tax expert team which deals with EU and non-EU tax issues. Andrea established the first tax epartment inside the Panasonic group, worldwide. Andrea has extensive experi-ence in merger & demerger group activities. She previously worked, for several years, at Deloitte in the International AT Department in Düsseldorf and prior to that operated her own business in Berlin (as an executive consultant).

Anthony Allgood is the HMRC policy lead for import VAT (including Postponed VAT Accounting). He has been on officer of HMRC (and previously HM Customs and Excise) for 27 years and has worked in a variety of roles in the department. Most notably he was an early pioneer in the use of Alternative Dispute Resolution (ADR) for tax disputes and is an accredited mediator. He was also a senior member of the team working on the Brexit transition, specialising in air freight, the cultural sector and ATA carnets.

.

Christian is a lawyer and certified tax advisor. He advises clients on all aspects of national and international VAT issues and specializes in customs and excise duty matters. His particular focus is on import VAT related issues as well as optimizing cross-border supply chains and processing schemes. Christian has extensive experience in carrying out SAP-VAT audits and customs reviews. He also accompanies external audits and represents clients before tax authorities and fiscal courts. His clients range from individuals to international groups.

He is regularly publishing comments, articles and annotations in VAT, customs and excises related topics.

Christina has been in HMRC for 6 years and has been working with the Overseas Repayment Unit (ORU) and the Non-established Taxable Persons Unit since 2021. She works closely with Policy on all aspects of overseas repayment claims and has contributed to several digital solutions including the launch of the Secure Data Exchange Service within the ORU. Following a secondment in Policy, she has been leading on proposals for reforming the overseas repayment process and meets biannually with the International VAT Association.

.

Graduated from HEC in 1997 with a specialisation in Finances, Cyrille Konter started his career in Germany within various investment banks as structureur and seller of derivatives on action. In 2003, he returns to France to take over the business development of TEVEA RF Consulting SASU.

.

David Hummel is since October 2016 legal secretary (référendaire) at the European Court of Justice at the cabinet of advocate general Kokott.

Before (2013 – 2016) he represented several tax law chairs at the Universities of Münster, Trier, Leipzig and Hamburg. In mid-2017 the appointment as a Professor at the University of Leipzig took place. His academic career starts with the Study of Law at the University of Leipzig, a Graduation (Phd) as an assistant of Prof. Dr. Stadie with a VAT-Thesis in 2009 and a Habilitation in 2013 with the matter: „Rechtsformneutralität im Öffentlichen Recht“ (neutrality of legal forms in public law – venia legendi: public law, especially tax law and public economic law).

David Hummel is one of the authors of, inter alia, „Rau/Dürrwächter“ (commentary of the VAT-Law), „Kirchhof/Söhn/Mellinghoff“ (commentary of the income tax law) and “Hübschmann/Hepp/Spitaler” (commentary of the procedure tax law). Furthermore, he is engaged as a tutor in the field of European Tax Law and State Aid Law.

Emmanuel is a French tax lawyer specializing exclusively in indirect taxes (VAT, Excise and Customs duties). After 10 years of experience at Price Waterhouse Tax and Legal and then Arthur Andersen International, he started his own consulting law firm in 2000. He has specifically built a significant experience in international supply chain structuring, ERP/SAP VAT implementations and multi-national advisory and compliance coordination. His main areas of activity are pharmaceuticals, energy utilities, aeronautics and chemicals. He is a partner of VAT Forum CV and regularly lectures at international VAT events.

Fabian Völkel is Founder and Managing Director of VAT4U. After legal studies in Münster, Düsseldorf, New York, and London, Fabian worked for 15 years in consultancy at Clifford Chance, KPMG, Ayming (Ex-Lowendalmasai) and TALA Consult before starting VAT4U. His professional focus is on cross-border VAT, combining operational aspects of VAT compliance and VAT recovery with IT technology. Fabian holds a Ph.D. from the University of Munster and an LL.M. (Tax) from the University of London.

Fernando Matesanz is the owner and Director of the firm named Spanish VAT Services Asesores SL. He Counts on more than 20 years of experience in providing advice in VAT.

He is an active Tax Lawyer, member of the Spanish Bar and a certified Tax Advisor.

Fernando began his carrier within the VAT Group of Ernst & Young. After that, he founded the firm Spanish VAT Services Asesores SL a firm exclusively working on international VAT matters and other Indirect taxes. Spanish VAT Services is currently the largest independent VAT services providers within the Spanish market.

Fernando is a Board Member of the IVA, a Member of the EU Commission´s VAT Expert Group and President of the Madrid VAT Forum Foundation.

Jane holds a degree in Economics from the University of Bradford School of Management and has during the last 30 years specialized in foreign VAT recovery services. From 1997, as General Manager for the United Cash Back franchise group, she developed the business model and complete processes to enable companies to recover their foreign VAT, liaising closely with business and the VAT authorities to generate compliant and efficient practices. Since the acquisition of Cash Back in 2019, she works with VAT IT Reclaim continuing to ensure best practices are in place between the claimants, agents and the authorities.

Jane has been an active member on and off the board of the International VAT association since its foundation.

Jane lives in Gothenburg, Sweden where she makes the most of all outdoor activities and the fantastic West Coast surroundings.

Jean is a graduate chartered accountant from the “Université des sciences sociales de Toulouse” and has an MBA from the University of Canterbury (Kent).

He moved to the UK the year of the EU single market 1993 for the Norbert Dentressangle Group and then moved to Shipping as Financial Controller of SeaFrance (SNCF group) dealing with the UK subsidiary and all fiscal maters in the UK. Jean joined DFDS as Indirect tax manager in 2013 and, for all his sins in a previous life, had to deal with the Brexit preparations looking after the AEO program, the training of staff to build a customs dept and the reintroduction of Duty Free for international travel. He has been active in the Taxation working group of the European community Shipowners Associations since 1997.

Jeremy is a barrister specialising in tax law at Pump Court Tax Chambers, London. He is chair of the Chartered Institute of Taxation’s European and Human Rights working group. He is also chair of the indirect tax committee of CFE Tax Advisors Europe and was one of its representatives on the European Commission VAT Expert Group. He has been awarded a certificate of merit by the CIOT. Cases he has argued include C-169/04 Abbey National -v- Customs and Excise Comrs, C-291/03 MyTravel v Customs and Excise Comrs and C-308/96 and C-94/97 Customs and Excise Comrs v Madgett and Baldwin.

Kristian Koktvedgaard is the past chairman of the BUSINESSEUROPE VAT policy group from 2010 until the end of 2023 and have participated in European VAT issues since 2004. The working group focus on both new legislation as well as existing legislation and provides both technical and political comments to the EU Commission as well as other key European and International stakeholders. He is a current member of the EU VAT Expert Group and have also been part of the EU VAT Forum and the EU Multistakeholder Forum on e-invoicing.

Kristian Koktvedgaard is Head of VAT, Accounting and Auditing at the Confederation of Danish Industry (DI) in Copenhagen.

Marcel Eggen is the Product Manager for VAT Refund claims (8th & 13th Directive incoming and outgoing) at the Dutch Tax Office for Foreign Taxpayers in Heerlen – The Netherlands. He is responsible for the workflows around VAT Refund and for the IT-solutions to support those workflows.

He has studied tax and economics (in Dutch: fiscale economie) and is a certified SAFe® Product Manager. His work area is therefore at the intersection of taxation and IT.

.

Martina has been in HMRC for 19 years and worked in different areas of the department including the VAT Written Enquiries team, the team responsible for providing technical replies to VAT queries.

She has worked in different policy areas, which include VAT Principles, she was the policy lead for both the EU VAT refunds and Overseas Repayment Scheme from July 2017 – Feb 2021 and worked collaboratively with external stakeholders including members of the IVA to deliver deduction policy that provides the right outcome for both HMRC and our customers.

She is currently the policy manager for VAT Deductions which include Import VAT Deduction.

Maxime Monleon is a policy officer working in the team in charge of policy and legal aspects of the Carbon Border Adjustment Mechanism (CBAM) in DG TAXUD (European Commission). With a background in political science, he had several experiences as deputy head of unit in the French Treasury (Direction générale du Trésor) of the Finance ministry on various economic policy proposals. From 2015 to 2019, he was head of sector in charge of international and EU discussions on direct tax matters in the Tax Policy Department (Direction de la legislation fiscale) of the Finance ministry. He then joined DG TAXUD and later the Permanent Representation of France to the EU during the Presidency of the EU Council.

Is an international VAT consultant. He has worked since 1996 in international VAT for a Big Four and worked several years in industry as in-house VAT manager. In 2010 he started his own VAT consulting firm ALLVAT. He is frequent speaker at international seminars, organizes trainings for the Federation of Dutch exporters, the Chamber of Commerce, the International VAT Expert Academy (IVEA) and is partner of VAT Forum CV. He is currently a board member of the IVA and liaises with the IVA members outside the EU. His focus is on the international supply chain in Europe and more recently the GCC.

Ruth is an Associate specialising in indirect taxes with Hiller Hopkins LLP in the UK. In her VPG role, Ruth has worked closely with HM Revenue and Customs (“HMRC”) on the “Making Tax Digital” project, ensuring that HMRC is fully aware of the challenges faced by taxpayers unused to accounting software. She has also been working with HMRC on the legislation for a “No Deal” Brexit.

She also represents the VPG and the Institute of Chartered Accountants in England and Wales (“ICAEW”) on various committees with HMRC and was seconded to the Office of Tax Simplification for seven months in 2017 to look at ways of simplifying the VAT code in the United Kingdom.

Stephen Dale is a partner at Roosevelt Associés – accountants and has worked in French taxation for more than twenty years, having previously worked with PricewaterhouseCoopers in France and in the UK.

Stephen is a member (and former Chairman) of the FEE (Fédération des Experts Comptables Européens) Tax Policy Group and chair of the Institute of Chartered Accountants in England and Wales VAT Committee. He represents the IVA on the VAT Expert Group and is a member of the OECD’s Global VAT Forum.

He is a board member of the Association de la Pratique de la TVA européenne (APTE) and the Association des représentants fiscaux français.

He is the author of several publications such as the VAT Yearbook – Kluwer, VAT Guides – PwC, and for PKF, Articles – International Indirect Tax, BNA, journals and newspapers.

Thibauld MANSON is currently Tax Attaché for Germany, Austria and Switzerland at the French Embassy in Berlin.

Prior to his current position, he was head of the VAT Refund Unit for foreign businesses, international organizations and diplomatic missions at the French tax directorate for non-residents (DINR).

Thibauld attended the Ecole Normale Supérieure (ENS) de Cachan and holds a Master’s Degree in Management Science as well as 20 years of experience in both public and private sectors regarding economic and tax issues.

Thomas is a certified tax consultant since 1993. He has been Head of Indirect Taxes / Customs at Schwarz Dienstleistung KG since 2013. (Lidl, Kaufland, PreZero). Previously, he worked for Henkel KGaA in Düsseldorf in Germany, the USA and Austria. Thomas is also co-founder of the platform www.taxpunk.de and deals intensively with the effects of digitalization on the tax environment.

.

Tiina Ruohola is a Senior Advisor on VAT at the Confederation of Finnish Industries. Tiina has worked with VAT for over 15 years, working for the Finnish Tax Administration and several consulting companies before joining the Confederation 4 years ago. Tiina is an active member of Business Europe’s VAT group and represents the Finnish businesses in the VAT Expert Group and the EU VAT Forum. In Finland, Tiina is also a member of the Board of Adjustments dealing with differences of opinion between taxpayers and the Tax Administration and the Central Board of Taxation, which is the body giving out advance ruling in major cases. Tiina’s motto is: you can talk about everything with a smile on your face – even about taxation.

Valerie has been working at the Ministry of Finance of Belgium since 2003 and more specifically at VAT Refund since 2016. She manages a team of 20 employees who also deal with OSS and occasional taxable persons.

.

Feedback for this Conference

“Many thanks for a great conference, once again. Thank you for the good co-operation during the past years – and of course this is by no means the end. I truly think IVA is a great platform for discussions in the area of VAT. Great work what you have done! Looking also forward to co-operation with Fernando. And once again, many thanks also to Alexandra for the organizing – everything was going super smoothly.”

Tiina RuoholaConfederation of Finnish Industries (Finland)

“Thank you for your brilliant contributions each of them individually making our conference a great success – with nearly 170 delegates in the room and over 100 members signed up to participate on line this last conference demonstrates that we still have a lot of work to do to try and eliminate the ‘grit from the machine’ and to get back to what VAT should be by its very nature – that is a ‘simple tax’. Projects are underway at EU level and in the UK to simplify the tax, which is clearly a significant task. Together, that is business, administrations, legislators and academics, we can achieve amazing progress towards this objective – this is what the IVA is all about. Thank you all once again for your amazing support and contributions and I (and our new President Fernando) look forward to seeing you all again soon.”

Stephen DaleIVA Board member

“The conference was very interesting. Especially useful for our company was a chance to hear from the different tax authorities on the challenges on their side when it comes to the VAT refund requests. It provided us clear indicators on what to look at when looking for improvements in our internal processes. The sessions were not too long, all the speakers’ presentations were well thought through and they delivered clear messages.”

Marta Zakrockablue dot (Netherlands)

“I would like to thank the Association for the invitation to the Conference, which I found very interesting and full of inputs”

Agata VeroneseItalian Tax Administration

“Thank you for organizing another great conference.”

Ryan DevanneyMeridian (Ireland)

Presentations

Conference Venue

Hotel Kö59 Düsseldorf

Königsallee 59, 40215 Düsseldorf, Germany

https://www.hommage-hotels.com/

Tel.: +49 211 82850

2023 Autumn Conference

Copenhagen, Denmark

19 and 20 October 2023

Topic: A Smart Tax: Making VAT Artificially Intelligent?

The digital future of VAT/GST and customs is being constructed. The generalization of e-invoicing and e-reporting tools will accelerate, and our universe turn even faster. Tax compliance will be on a real-time basis, tax audits as we know them will disappear and will be based on the contemporaneous flows of data; tax consultancy will be tools-driven. IT intelligence will empower tax administrations with an extraordinary potential. Businesses will develop data strategies to cope with higher expectations. Can we make IT smart?

Speakers for This Conference

Christian is a lawyer and certified tax advisor. He advises clients on all aspects of national and international VAT issues and specializes in customs and excise duty matters. His particular focus is on import VAT related issues as well as optimizing cross-border supply chains and processing schemes. Christian has extensive experience in carrying out SAP-VAT audits and customs reviews. He also accompanies external audits and represents clients before tax authorities and fiscal

courts. His clients range from individuals to international groups.

He is regularly publishing comments, articles and annotations in VAT, customs and excises related topics.

Graduated from HEC in 1997 with a specialisation in Finances, Cyrille Konter started his career in Germany within various investment banks as structureur and seller of derivatives on action. In 2003, he returns to France to take over the business development of TEVEA RF Consulting SASU.

.

David Hummel is since October 2016 legal secretary (référendaire) at the European Court of Justice at the cabinet of advocate general Kokott. Before (2013 – 2016) he represented several tax law chairs at the Universities of Münster, Trier, Leipzig and Hamburg. In mid-2017 the appointment as a Professor at the University of Leipzig took place. His academic career starts with the Study of Law at the University of Leipzig, a Graduation (Phd) as an assistant of Prof. Dr. Stadie with a VAT Thesis in 2009 and a Habilitation in 2013 with the matter: „Rechtsformneutralität im Öffentlichen Recht“ (neutrality of legal forms in public law – venia legendi: public law, especially tax law and public economic law).

David Hummel is one of the authors of, inter alia, „Rau/Dürrwächter“ (commentary of the VAT-Law), „Kirchhof/Söhn/Mellinghoff“ (commentary of the income tax law) and “Hübschmann/Hepp/Spitaler” (commentary of the procedure tax law). Furthermore, he is engaged as a tutor in the field of European Tax Law and State Aid Law.

Emilia Teresa Sroka is a licensed attorney-at-law and a specialist in the field of EU law, with expertise in VAT and new technologies. She holds a master’s degree in law from Jagiellonian University in Poland. From 2010 to 2016, she worked for major Polish law firms, including SK&S and Deloitte. Emilia has expanded her expertise by completing courses in “Chinese Law Taught in English” at universities in Beijing and Shanghai, thanks to the UNESCO “Great Wall” scholarship program. Between 2019 and 2023, she served as the chief policy officer on international VAT law at the Polish Ministry of Finance. During this period, she also contributed her expertise to the European Commission (DG TAXUD C1) in Brussels, where she worked from March to July 2022. Emilia has actively participated as a speaker in various international debates and conferences. She has published articles on VAT policy in the digital age and the evolution of the one-stop shop in the EU VAT system. Currently, Emilia is pursuing her Ph.D. at Kozminski University and is a member of the Polish Tax Scientific Association.

Emmanuel is a French tax lawyer specializing exclusively in indirect taxes (VAT, Excise and Customs duties). After 10 years of experience at Price Waterhouse Tax and Legal and then Arthur Andersen International, he started his own consulting law firm in 2000. He has specifically built a significant experience in international supply chain structuring, ERP/SAP VAT implementations and multi-national advisory and compliance coordination. His main areas of activity are pharmaceuticals, energy utilities, aeronautics and chemicals. He is a partner of VAT Forum CV and regularly lectures at international VAT events.

.

Fabian Völkel is Founder and Managing Director of VAT4U. After legal studies in Münster, Düsseldorf, New York, and London, Fabian worked for 15 years in consultancy at Clifford Chance, KPMG, Ayming (Ex-Lowendalmasai) and TALA Consult before starting VAT4U. His professional focus is on cross-border VAT, combining operational aspects of VAT compliance and VAT recovery with IT technology. Fabian holds a Ph.D. from the University of Munster and an LL.M. (Tax) from the University of London

.

Fernando Matesanz is the owner and Director of the firm named Spanish VAT Services Asesores SL. He Counts on more than 20 years of experience in providing advice in VAT.

He is an active Tax Lawyer, member of the Spanish Bar and a certified Tax Advisor. Fernando began his carrier within the VAT Group of Ernst & Young. After that, he founded the firm Spanish VAT Services Asesores SL a firm exclusively working on international VAT matters and other Indirect taxes. Spanish VAT Services is currently the largest independent VAT services providers within the Spanish market. Fernando is a Board Member of the IVA, a Member of the EU Commission´s VAT Forum and President of the Madrid VAT Forum Foundation.

Gwenaelle is a partner at Ernst & Young Société d’Avocats specialized in Tax Technology and Indirect Taxes (VAT, customs). She has a Double Master degree in Business and International law. Gwenaelle is a Tax Lawyer (Avocat) since 1994.

Her representative activities in EY are: Energy (EY Europe West Tax leader), Life Sciences and Transportation services. Her specific expertise is in: Tax technology (mainly, ERP implementations, e-invoicing, data analysis, RPA and Blockchain), VAT & Customs, Tax law and International Business law.

Gwenaelle is fluent in French and English.

Hans Joachim Narzynski is head of division in the Ministry’s directorate for customs and indirect taxation. In this position he is dealing with international VAT matters, in particular with the negotiations on European regulations and their application. Hans Joachim Narzynski joined the tax administration in Germany in 1998, working for the Federal Ministry of Finance since 2013. He previously worked in different local tax offices in the federal state of Saxony and as an advisor in the Federal Parliament of Germany.

.

Jean is a graduate chartered accountant from the “Université des sciences sociales de Toulouse” and has an MBA from the University of Canterbury (Kent).

He moved to the UK the year of the EU single market 1993 for the Norbert Dentressangle Group and then moved to Shipping as Financial Controller of SeaFrance (SNCF group) dealing with the UK subsidiary and all fiscal maters in the UK. Jean joined DFDS as Indirect tax manager in 2013 and, for all his sins in a previous life, had to deal with the Brexit preparations looking after the AEO program, the training of staff to build a customs dept and the reintroduction of Duty Free for international travel. He has been active in the Taxation working group of the European community Shipowners Associations since 1997.

Justyna is an indirect Tax professional with 15 years of practical experience in IT, petroleum and tobacco industries. Over those years, Justyna participated in various projects like: VAT package implementation, preparing businesses for VAT introduction in UAE, setting up a new ERP system for multinational company or dealing with VAT implications deriving from the company’s merger.

After successful implementation of VAT quick fixes and several CTC requirements across Europe, currently owning VAT advisory role in Bolt – the first European mobility super-app.

Marcos Álvarez is a senior Tax Auditor in the Spanish Tax Administration in Madrid, where he´s been working for 25 years. He worked as a Tax Inspector in Barcelona, as a head officer of the Enforced Collection services and as a member of the Regional Administrative Tax Court in Madrid, before joining the Head Department of Tax Auditing, where He was appointed as Deputy Director for Legal Matters during 12 years (2009-2022). Although he worked in different fields (direct taxation, aggressive tax planning, enforced collection) his main expertise is focused in VAT, auditing and control procedures and strategies, and upholding the Tax Authorities cases upon the Courts (both national and EUCJ). He´s been speaking and contributing to many international workshops and conferences about VAT in the International VAT Association, Vienna University (WU), etc. He´s author of many articles about VAT in Spanish and international publications, including the International VAT Monitor with the IBFD. He was selected by the OECD, WB, IDB and CIAT as a senior expert to produce the Toolkit for VAT in the digital Era for LAC region, and also provided assistance to the OECD to the ones targeted to the South East Asia and Africa regions. With IDB. OECD and CIAT, he has taken part in technical assistances to introduce the VAT to digital economy in Panamá, Argentina, Saudi Arabia and Dominican Republic. He holds a Law degree from Universidad Complutense (Madrid)

Manuel Sieben is a tax advisor and, as managing director at AWB Steuerberatungsgesellschaft (AWB Tax Consultancy), is responsible for advising clients, especially in the areas of customs and preferential law. In particular, he is the contact person for legal issues and the implementation and optimisation of process organisation with regard to compliance with regulations relevant to foreign trade.

Until mid-2011, he worked in the senior service of the German customs administration at the main customs offices in Krefeld and Düsseldorf. He also completed the internationally oriented Master of Customs Administration (MCA) degree programme at the University of Münster.

At the AWA AUSSENWIRTSCHAFTS-AKADEMIE (AWA FOREIGN TRADE ACADEMY) he regularly holds seminars on customs and preferential law topics as a lecturer. He is also an author of various publications on customs law.

LL.D. Marta Papis-Almansa is an associate Professor. She is a lecturer and researcher specializing in VAT. Currently she is a MSCA Fellow at the University of Copenhagen (Denmark) where she pursues an individual research project on the advantages and challenges of the use of new technologies in VAT reporting, collection and auditing (VATTECH). She is also associated with Lund University and Kristianstad University (Sweden). In Lund she for several years she has been responsible for indirect tax education at the Master’s Programme in European and International Tax Law. Marta has been also case law section co-editor at INTERTAX (Wolters Kluwer). She has experience in educating and advising business on issues of European VAT. In 2017 Marta was awarded the Maurice Lauré Prize by International Fiscal Association for her doctoral thesis on “Insurance in European VAT: On the Current and Preferred Treatment in the light of New Zealand and Australian GST Systems”.

Dr. Martin A. Sepiol is an experienced Data and AI Manager at PwC Switzerland, specialising in disruptive technologies for tax and legal services. He is a trusted advisor to executive management in med-tech, manufacturing, and governmental organizations. Martin is skilled in developing enterprise-grade solutions based on generative AI, large language models, machine learning, data analytics, and modern data stacks. He has background in physics, with a doctorate in quantum computing from the University of Oxford. Previously worked in the manufacturing industry, leading large-scale product development projects in the area of sensor technology and IoT, and overseeing industrialization processes.

Michaela is the Leading Indirect Tax Partner in PwC Switzerland, with over 25 years of professional experience in advising domestic and multinational companies in indirect tax matters.

Within the PwC network, Michaela served as Global Indirect Tax Leader and the Global Leader for Indirect Strategy and Operations.

.

Mojca Grobovsek is an indirect tax specialist and has been working in the field of VAT for 11 years now. She has started as a VAT Manager in a private company specialized in VAT recovery and VAT Compliance. In 2011, she wanted to give another significant dimension to my career. She therefore decided to join the Paris Chamber of Commerce, where she was working as a tax expert for the Enterprise Europe Network, which aims at helping SME,’s to develop and to support their activities on the European market. In July 2016, Mojca has joined Ayming as a VAT Expert where she identifies tax risks and propose compliant VAT schemes to their clients and their subsidiaries. Mojca also participates to commercial and partnership development. She deals with technical analysis of all kind of indirect tax issues and has a strategic oversight of the businesses. Mojca is also an official trainer on indirect taxation (VAT and customs) for the Paris Chamber of Commerce and takes often part of different conferences as a guest or as a speaker.

After studying law at the Universities of Marburg, Münster and Paris, Dr. Nathalie Harksen is working as a lawyer in tax law.

She is a managing partner of AWB Steuerberatungsgesellschaft and AWB Rechtsanwaltsgesellschaft with offices in Münster, Munich and Hamburg. The AWB provides a further platform for assisting multinationals in their cross-border activities relating to customs, VAT, excise duties and export controls. Nathalie specializes in the customs and VAT implications of cross-border transactions. Due to her studies in customs law at the University of Münster, she advises multinational clients on the interfaces between VAT and customs with particular emphasis on VAT, import VAT and Incoterms.

She is an experienced trainer and holds seminars throughout Germany for the management staff of major German companies in VAT, customs and intrastat topics. She also has been accredited by the ICC as trainer for Incoterms2010. Furthermore, she is a guest lecturer at the Federal Finance Academy in Berlin.

Nathalie is one of the authors of „Rau/Dürrwächter“ (commentary of the VAT-Law – § 21 import VAT and § 21a special arrangement) and publishes regularly on customs and VAT issues.

Neil is currently Head of VAT Principles, Indirect Tax Directorate, HM Revenue and Customs with responsibility for the policy development and protection of the core legal framework and principles that defines VAT, which includes the impact of new and emerging technologies on VAT. Beyond the UK, he is supporting the OECD on the development of a paper on Crypto Assets and provide advice on strategic VAT risk management as part of the UK’s programme of support to the Gulf Cooperation Council member states. On Before joining policy, he had a 20+ year career leading operational VAT, excise and International Trade teams in HMRC, specialising in tackling fraud and non-compliance.

Ninja is senior lead for tax policy at Zalando SE based in Berlin. With a Master of Laws and Master in International Relations she has worked at the crossroads of tax law and policy for over 10 years with engagements at PwC, the OECD and the German family business association. She later specialized in VAT law as tax policy advisor of the German Ministry of Economic Affairs before joining Zalando in 2022. Ninja is chair of the Young IFA network in Germany and member of the EU VAT Expert Group.

Patrice Pillet is the Head of Unit of the VAT Unit, in DG Taxud (European Commission). He is responsible for the development and implementation of EU VAT policy, and notably for the VAT in the digital age negotiations.

He was previously Head of DG TAXUD’s legal Unit and has also been Head of Sector responsible for VAT on electronic commerce (2008-1016). He has also previously been responsible for international affairs and technical assistance in the Customs Directorate of DG Taxud (2004-2008), as well as for fighting VAT fraud and promoting mutual assistance in tax matters (1998-2004).

Piet Battiau is the Head of the Consumption Taxes Unit in the Centre for Tax Policy and Administration (CTPA) of the OECD. He is responsible for the OECD’s expanding work on indirect taxes, including the International VAT/GST Guidelines and the OECD Global Forum on VAT.

He has been included in the International Tax Review’s Global Tax 50 of the world’s most influential persons in tax policy and practice every year since its inception in 2011.

Piet joined the OECD in 2011. He began his career as a tax inspector for the Belgian Ministry of Finance in the early 1990’s before moving on to an international financial institution in 1995, where he became Head of International Taxation and subsequently Head of Public Policy. He was also Chairman of the Fiscal Committee of the European Banking Federation. He studied Law in Brussels and Ghent and holds a Law degree and a degree in Tax Science.

Is an international VAT consultant. He has worked since 1996 in international VAT for a Big Four and worked several years in industry as in-house VAT manager. In 2010 he started his own VAT consulting firm ALLVAT. He is frequent speaker at international seminars, organizes trainings for the Federation of Dutch exporters, the Chamber of Commerce, the International VAT Expert Academy (IVEA) and is partner of VAT Forum CV. He is currently a board member of the IVA and liaises with the IVA members outside the EU. His focus is on the international supply chain in Europe and more recently the GCC.

Shaikh Abdul Samad is a distinguished Chartered Accountant and a valued partner at Sanjiv Shah & Associates, a Chartered Accountancy firm in Chennai, India. CA. Samad is the head of the Indirect Taxes Compliance Team and ensures that his clients remain compliant while optimizing their tax strategies.

He has extensive experience in Indirect Tax laws compliance dating back to the pre-GST regime. He has witnessed the evolution of indirect tax laws and has successfully guided clients through various changes and reforms in the tax landscape. The rich experience acquired over the years has made CA. Samad devise effective strategies and navigate the complexities associated with compliance seamlessly.

Sophie is a member of Amazon’s EU public policy team in Brussels where she is leading and coordinating Amazon’s VAT and corporation tax policy efforts at a pan-EU level.

She has previously worked as a tax advisor at PwC and has advised many technology, ecommerce, media and telecoms businesses on VAT. She works closely with EU policy stakeholders on reforms to the VAT system, including the implementation of the VAT ecommerce package, but also on future VAT reforms. She holds a Master degree in Law and an Executive Master in Taxation. She is author of different publications on VAT and the digital economy.

.

Søren Jensen is a chief adviser in the VAT Unit of the Legal division of the Danish Tax Agency. He has previously worked at the regional tax office in Elsinore and at the Danish Ministry of Taxation. He has contributed to the work of the VAT Expert Group other EU expert groups.

.

Stephen Dale is a partner at Roosevelt Associés – accountants and has worked in French taxation for more than twenty years, having previously worked with PricewaterhouseCoopers in France and in the UK.

Stephen is a member (and former Chairman) of the FEE (Fédération des Experts Comptables Européens) Tax Policy Group and chair of the Institute of Chartered Accountants in England and Wales VAT Committee. He represents the IVA on the VAT Expert Group and is a member of the OECD’s Global VAT Forum. He is a board member of the Association de la Pratique de la TVA européenne (APTE) and the Association des représentants fiscaux français. He is the author of several publications such as the VAT Yearbook – Kluwer, VAT Guides – PwC, and for PKF, Articles – International Indirect Tax, BNA, journals and newspapers.

Tuula Karjalainen is a Master of Laws and works as the Head of VAT Unit (Tax Department) at the Ministry of Finance. She has over 20 years of experience with VAT, having held various positions in both the public and private sectors. In her current role, Tuula is responsible for preparing and implementing domestic and EU VAT legislation in her unit, also taking part in the work of the Working Party on Tax Questions / Indirect Taxation, VAT Committee and the Group on the Future of VAT. Tuula has previously worked for customs administration and two of the Big 4 companies. She has also served as an administrative court judge at the Helsinki Administrative Court handling appeals concerning indirect taxation. Tuula is a member of the Central Board of Taxation.

Feedback for this Conference

“It was truly an outstanding event, and I couldn't agree more about the fantastic venue, gala dinner, and our post-conference gathering at the Irish pub. The atmosphere was vibrant, and it seemed like everyone was in high spirits. The choice of AI and VAT as the conference topic was spot-on, and our lineup of speakers did a great job. I also appreciated the well-thought-out balance between the session lengths and the networking time – it made for a highly productive and enjoyable experience.”

Fabian VölkelVAT4U (Germany)

“Thanks again for your kind invitation and for your warm hospitality! I thoroughly enjoyed catching up with VAT practitioners and found the presentations and discussions highly relevant and informative!”

Piet BattiauOECD

“I would like to congratulate you for the top notch organisation of the conference held last week. Everything was perfect.”

Shirley CaruanaErremme Business Advisors Limited (Malta)

“Special big thanks for the organization of these learning sessions, dinners, and the conference. It was intensive 3 days but interesting and for sure 100% worth attending such an event.”

Joanna WichlaczMarosa (Spain)

“It was great meeting you all last week – the conference was amazing.”

Danielle KnottVATiT (South Africa)

“The conference was great, and very well organized, thank you again for your kind support!”

Emilia Teresa SrokaKozminski University (Poland)

“It was a really interesting conference.”

Wim HundscheidVATVision BV (Netherlands)

“Thanks again a lot for the great organisation of the conference.”

David HummelEuropean Court of Justice

“Congratulations to the team on the perfect organisation!”

Jean AubertDFDS A/S (Denmark)

“Thanks again for a wonderful conference in Denmark. I liked the choice of hotel and location.”

Cedric PinnsonaulCTAX Solutions, Inc. (Canada)

“I wanted to congratulate you on the Denmark event. I sat through all the sessions online. Absolutely first-class sessions. The best yet!”

Richar AsquithVAT Calc Limited (Belgium)

Presentations

Conference Venue

Villa Copenhagen

Copenhagen Central Post Building,

Tietgensgade 35-39, 1704 Copenhagen, Denmark

https://villacopenhagen.com/

Tel.: +45 78 73 00 00

2023 Spring Conference

Noordwijk (Amsterdam), The Netherlands

11 and 12 May 2023

Topic: The world of VAT – a kind of fiscal theme park

An English judge once stated that… “the world of VAT, (is like) a kind of fiscal theme park in which factual and legal realities are suspended or inverted”.

In our conference we will explore this “fiscal theme park” together, reflecting on the rollercoaster ride of the last 30 years of the transitional VAT system. We will also consider and looking ahead how VAT systems are becoming even more complex and the measures that can and need to be taken to reduce fraud by embracing the ever increasing digitalisation of business and addressing VAT challenges caused by the platform economy.

Our focus will be on the VAT in the Digital Age package, e-invoicing and e-reporting systems being introduced nationally and regionally, the extension of the single place of registration and the One Stop Shop regimes, together with the new proposed rules for supplies of short-term accommodation and passenger transport.

We will also be covering developments in environmental taxes and the CBAM, customs, and the latest cases from the EUCJ. A very full programme to look forward to in Noordwijk.

Speakers For This Conference

Alexia works at Marosa as a Senior tax advisor. She has been in the company for over four years. She worked in the VAT compliance team, ensuring they meet all VAT returns deadlines, assisting clients in VAT audits, and was also involved in the VAT registrations team.

At the moment, she leads the Knowledge area, from where she supports different teams in Marosa. Her main goals are keeping their team and audience updated on EU VAT changes and implementing internal training actions.

Bart Caluwé is Director of Indirect Tax at Expedia Group. He is responsible for dealing with indirect tax legislative developments internationally (excl. North America), advising B2C brands and supply partner relationships.

Prior to Expedia, Bart was EMEA VAT Lead at HP where he had VAT responsibility for the region as well as marketing programs. He was involved in spin-off and acquisition work, the VAT impact of the Union Customs Code and advocacy on anti-VAT fraud measures.

Christian is a lawyer and certified tax advisor. He advises clients on all aspects of national and international VAT issues and specializes in customs and excise duty matters. His particular focus is on import VAT related issues as well as optimizing cross-border supply chains and processing schemes. Christian has extensive experience in carrying out SAP-VAT audits and customs reviews. He also accompanies external audits and represents clients before tax authorities and fiscal courts. His clients range from individuals to international groups.

He is regularly publishing comments, articles and annotations in VAT, customs and excises related topics

Graduated from HEC in 1997 with a specialisation in Finances, Cyrille Konter started his career in Germany within various investment banks as structureur and seller of derivatives on action. In 2003, he returns to France to take over the business development of TEVEA International.

David Hummel is since October 2016 legal secretary (référendaire) at the European Court of Justice at the cabinet of advocate general Kokott.

Before (2013 – 2016) he represented several tax law chairs at the Universities of Münster, Trier, Leipzig and Hamburg. In mid-2017 the appointment as a Professor at the University of Leipzig took place. His academic career starts with the Study of Law at the University of Leipzig, a Graduation (Phd) as an assistant of Prof. Dr. Stadie with a VAT-Thesis in 2009 and a Habilitation in 2013 with the matter: „Rechtsformneutralität im Öffentlichen Recht“ (neutrality of legal forms in public law – venia legendi: public law, especially tax law and public economic law).

David Hummel is one of the authors of, inter alia, „Rau/Dürrwächter“ (commentary of the VAT-Law), „Kirchhof/Söhn/Mellinghoff“ (commentary of the income tax law) and “Hübschmann/Hepp/Spitaler” (commentary of the procedure tax law). Furthermore, he is engaged as a tutor in the field of European Tax Law and State Aid Law.

Emmanuel is a French tax lawyer specializing exclusively in indirect taxes (VAT, Excise and Customs duties). After 10 years of experience at Price Waterhouse Tax and Legal and then Arthur Andersen International, he started his own consulting law firm in 2000. He has specifically built a significant experience in international supply chain structuring, ERP/SAP VAT implementations and multi-national advisory and compliance coordination. His main areas of activity are pharmaceuticals, energy utilities, aeronautics and chemicals. He is a partner of VAT Forum CV and regularly lectures at international VAT events.

Emmanuelle Levieils is a project manager in the Electronic invoicing Project Department of the French Ministry of Economy, Finance and Industrial and Digital Sovereignty.

…

Emmanuelle Mouard is a member of the “Electronic invoicing” project group of the French General Directorate of Public Finances since 2021. Emmanuelle Mouard is in charge of IT topics and communication.

She previously worked in the communication department before joining the non-resident tax directorate where she was in charge of management and recovery services for foreign compagnies.

…

Frank is Director of the National Committee on Trade Facilitation of the Netherlands and Head of Trade Relations at the Netherlands Customs. Next he teaches about Customs, Trade facilitation and Enforcement at several academic institutes in NL and Germany and he is a member of the teaching team at Erasmus University Rotterdam School of Management (RSM), MSc program Customs & Supply Chain Compliance. Frank holds over 36 years of Customs experience, having an in-depth knowledge in the fields of customs legislation international business and logistics, e-commerce, enforcement strategy and he is co-author of the book ‘Customs, Inside Anywhere, insights everywhere’.

Ian started his career with HMRC (and its predecessor department HM Customs & Excise) over 30 years ago and has worked in a number of roles, mostly in VAT but also other indirect taxes. For the last 20 years, he has been working on VAT policy, including a three-year secondment to HM Treasury (2008-2011). He has broad experience across a range of VAT policy areas, including extensive experience in international forums. Ian is currently a Deputy Director in Indirect Tax Directorate in HMRC, responsible for policy on VAT Reliefs, Deductions and Financial Services.

Ilse Verouden is working in VAT law since 1994, at first with Deloitte and then with Loyens & Loeff, both in Rotterdam. As of 2013 she is working for the Dutch tax authorities/Ministry of Finance. She has worked as a VAT inspector in the unit for financial institutions and as a policy advisor.

In her current role Ilse is responsible for the national coordination of the VAT practice of the Dutch tax authorities.

She is also involved in the EU VAT Committee.

Ine Lejeune is an independent attorney with 39 years of experience in VAT policy, advice, dispute resolution and litigation.

She has led PwC’s Global Indirect Tax Practice and conducted more than 40 studies on tax/VAT for the EU Commission/EU Parliament. She has published extensively on the subject (books and articles). Ine was a member of the EU VAT Expert Group (2012-2019) and is a member of the OECD’s Consumption Tax TAG.

She has done policy work for EU Member States and globally (China (VAT reform programme), the UAE (introduction of VAT) and development of The Unified VAT Agreement for The Cooperation Council for the Arab States of the Gulf).

She has lectured at the University of Antwerp (UFSIA), the VUB, the Vienna University of Economics and Business (WU) and given guest lectures at universities in the EU and China. She has spoken at conferences organised by the European Commission, by universities and other organisers.

She is doing a PhD at the University of Amsterdam (UvA) and co-chairs with Professor J. Owens WU University’s work on cross-border VAT dispute prevention and resolution.

She is a member of the editorial board of the International VAT Monitor, IFA and the International Vat Association.

Jane holds a degree in Economics from the University of Bradford School of Management and has during the last 30 years specialized in foreign VAT recovery services. From 1997, as General Manager for the United Cash Back franchise group, she developed the business model and complete processes to enable companies to recover their foreign VAT, liaising closely with business and the VAT authorities to generate compliant and efficient practices. Since the acquisition of Cash Back in 2019, she works with VAT IT Reclaim continuing to ensure best practices are in place between the claimants, agents and the authorities.

Jane has been an active member on and off the board of the International VAT association since its foundation.

Jane lives in Gothenburg, Sweden where she makes the most of all outdoor activities and the fantastic West Coast surroundings.

Jean is a graduate chartered accountant from the “Université des sciences sociales de Toulouse” and has an MBA from the University of Canterbury (Kent).

He moved to the UK the year of the EU single market 1993 for the Norbert Dentressangle Group and then moved to Shipping as Financial Controller of SeaFrance (SNCF group) dealing with the UK subsidiary and all fiscal maters in the UK. Jean joined DFDS as Indirect tax manager in 2013 and, for all his sins in a previous life, had to deal with the Brexit preparations looking after the AEO program, the training of staff to build a customs dept and the reintroduction of Duty Free for international travel. He has been active in the Taxation working group of the European community Shipowners Associations since 1997.

Lena Odelberg works as a senior director at Volvo. She is acting as the Senior VAT Policy Advisor. The overall responsibility means that she is engaged in all kind of VAT issues around the world. Previusly from 1986 until 1998 she was working at the Tax Authority (local) in Gothenburg and Stockholm in Sweden.

…

Mathijs Klemm works as a VAT specialist at the Foreign Office of the Dutch Tax Authorities, with international trade and e-commerce as his main focus. He has been working at the Foreign Office for the past ten years after obtaining his master’s degree in tax law at Maastricht University. Mathijs is further affiliated to Maastricht University both as a lecturer on indirect taxation as well as a PhD candidate. Occassionally, he publishes in journals on VAT related issues.

Patrice Pillet is the Head of Unit for indirect taxation legal affairs, in DG Taxud (European Commission). He is therefore responsible for the management of complains, the handing of infringement procedures as well as other legal issues (including preliminary rulings) in the area of indirect taxation.

He was previously Head of Sector responsible for VAT on electronic commerce (2008-1016). He has also previously been responsible for international affairs and technical assistance in the Customs Directorate of DG Taxud (2004-2008), as well as for fighting VAT fraud and promoting mutual assistance in tax matters (1998-2004).

Phil is a senior policy advisor at HMRC, specialising on Northern Ireland Protocol VAT policy. His team is responsible for the implementation of VAT policy in Northern Ireland.

Following roles in telecoms and publishing, Phil joined the civil service in 2012 and worked on strategy and new school delivery in the Department for Education before joining HMRC in 2020.

He has a degree in International Relations from the University of Leicester.

Is an international VAT consultant. He has worked since 1996 in international VAT for a Big Four and worked several years in industry as in-house VAT manager. In 2010 he started his own VAT consulting firm ALLVAT. He is frequent speaker at international seminars, organizes trainings for the Federation of Dutch exporters, the Chamber of Commerce, the International VAT Expert Academy (IVEA) and is partner of VAT Forum CV. He is currently a board member of the IVA and liaises with the IVA members outside the EU. His focus is on the international supply chain in Europe and more recently the GCC.

Ruth is the national Technical Chair for the VAT Practitioners Group. She is also an Associate specialising in indirect taxes with Hiller Hopkins LLP in the UK. In her VPG role, Ruth has worked closely with HM Revenue and Customs (“HMRC”) on the “Making Tax Digital” project, ensuring that HMRC is fully aware of the challenges faced by taxpayers unused to accounting software. She has also been working with HMRC on the legislation for a “No Deal” Brexit.

She also represents the VPG and the Institute of Chartered Accountants in England and Wales (“ICAEW”) on various committees with HMRC and was seconded to the Office of Tax Simplification for seven months in 2017 to look at ways of simplifying the VAT code in the United Kingdom.

Stephen Dale is a partner at Roosevelt Associés – accountants and has worked in French taxation for more than twenty years, having previously worked with PricewaterhouseCoopers in France and in the UK.

Stephen is a member (and former Chairman) of the FEE (Fédération des Experts Comptables Européens) Tax Policy Group and chair of the Institute of Chartered Accountants in England and Wales VAT Committee. He represents the IVA on the VAT Expert Group and is a member of the OECD’s Global VAT Forum.

He is a board member of the Association de la Pratique de la TVA européenne (APTE) and the Association des représentants fiscaux français.

He is the author of several publications such as the VAT Yearbook – Kluwer, VAT Guides – PwC, and for PKF, Articles – International Indirect Tax, BNA, journals and newspapers.

Thomas founded Aurifer, an award-winning boutique tax firm established in Dubai and Riyadh, with a representation office in Brussels. After a decade of working at tier 1 tax law firms in Brussels and Paris, and after having been seconded with Deloitte in the Gulf, it was time to spread his wings and personally serve the exciting Gulf market. He is grateful to be surrounded by high quality people who want to make

their mark in the Gulf tax market.

Thomas has been involved in several high-profile deals and have worked for blue chip and quoted companies and institutions in various sectors. In recent years Thomas has also been heavily involved in tax policy in Europe and the Gulf. Recently, he has been assisting businesses in assessing them with their readiness for the introduction of VAT and Corporate Income Tax and helping them with coping with new tax challenges in the Gulf driven by tax reform. He advises businesses on compliance with direct taxation and transfer pricing in the region.

He is the Editor in Chief of Gulf Tax Magazine and Co-Chair of the Middlesex/Aurifer GCC Tax Certificate. Thomas is also teaching taxation at Paris Sorbonne Abu Dhabi. He holds a law degree of the Catholic University of Leuven (cum laude) and a tax master’s degree of Solvay Business School (magna cum laude).

Tiina Ruohola is a Senior Advisor on VAT at the Confederation of Finnish Industries. Tiina has worked with VAT for over 15 years, working for the Finnish Tax Administration and several consulting companies before joining the Confederation 4 years ago. Tiina is an active member of Business Europe’s VAT group and represents the Finnish businesses in the VAT Expert Group and the EU VAT Forum. In Finland, Tiina is also a member of the Board of Adjustments dealing with differences of opinion between taxpayers and the Tax Administration and the Central Board of Taxation, which is the body giving out advance ruling in major cases. Tiina’s motto is: you can talk about everything with a smile on your face – even about taxation.

Tuula Karjalainen is a Master of Laws and works as the Head of VAT Unit (Tax Department) at the Ministry of Finance. She has over 20 years of experience with VAT, having held various positions in both the public and private sectors. In her current role, Tuula is responsible for preparing and implementing domestic and EU VAT legislation in her unit, also taking part in the work of the Working Party on Tax Questions / Indirect Taxation, VAT Committee and the Group on the Future of VAT. Tuula has previously worked for customs administration and two of the Big 4 companies. She has also served as an administrative court judge at the Helsinki Administrative Court handling appeals concerning indirect taxation. Tuula is a member of the Central Board of Taxation.

Feedback for this Conference

“I would like to congratulate the organization of the last event and thank you for adding me to the group of guests. I am positively surprised by the scale of the project and the relational possibilities offered by your organization.“ (After the Noordwijk May Conference 2023)”

Luisiana DobrinescuDOBRINESCU DOBREV SCA (Romania)

“I would like to congratulate the organization of the last event and thank you for adding me to the group of guests. I am positively surprised by the scale of the project and the relational possibilities offered by your organization.”

Jacek MatarewiczKancelaria Ożóg Tomczykowski sp. z o.o. (Poland)

“By this message, we thank you again for your invitation to IVA meeting in Leiden and the organization. It is always interesting event.”

Emmanuelle LevieilsFrench Tax Administration

“Thank you for another excellent conference.”

Andrew BurnsCruise Lines International Association (CLIA) Europe

“Thanks for the brilliant meeting last week.”

Luca ClivatiSovos (UK)

“Thank you for organising another great conference.”

Ryan DevanneyMeridian (Ireland)

Presentations

Conference Venue

Grand Hotel Huis ter Duin

Kon. Astrid Boulevard 5,

2202 BK Noordwijk, Netherlands

https://huisterduin.com

Tel.: +31 71 361 9220

2022 Autumn Conference

Barcelona, Spain

20 and 21 October 2022

Topic: The role of taxation in sustainability – a carrot or a stick?

The Autumn conference will look at the role of taxation in sustainability and the environment. With many jurisdictions introducing and amending tax legislation to fit the global environmental agenda, the indirect tax world looks set to significantly change. However, is taxation really the answer? Can businesses and Governments be more creative with solutions?

The IVA has invited speakers from business, tax authorities and professional associations to share their thought provoking views for members to consider and discuss.

Speakers For This Conference

Alex Baulf is Senior Director, Global Indirect Tax with Avalara. Alex is responsible for tracking international indirect tax and e-invoicing legislation and policy, parsing and articulating impact (across Avalara’s products, content and strategy), and dialoguing with Government, tax authorities, policymakers and customers. Alex has 17 years’ experience within Global VAT / GST and sales tax, working in the UK and USA and on projects across the EMEA region. Previously, Alex was a Director and Principal at Grant Thornton and a member of the Grant Thornton global indirect tax leadership team. Earlier in his career, he was seconded to Grant Thornton LLP’s Chicago office where he provided global VAT and GST advice to US clients with a global footprint or international supply chain. He has experience on large global indirect tax change management and transformation projects across people, process, systems and data.

Alex Cooksley leads the International VAT and Excise Unit in the UK’s economic and finance ministry, HM Treasury. The unit is responsible for cross-border VAT and excise policy, international negotiations, VAT aspects of the Northern Ireland Protocol and international engagement, including the UK’s input into the OECD indirect tax working group.

Over the past eight years Alex has worked across various roles in HM Treasury and HM Revenue & Customs. Prior to joining the UK Civil Service Alex studied as an economist, completing an MSc at University College London.

Andrew’s career began as a broadcast journalist with the BBC Radio and after completing and MBA worked as an international business development consultant for SMEs and multinationals.

TGS (Think Global Sustainability) is a dynamic global business network of independent firms providing accounting, audit, tax, business advisory and commercial legal services. Currently operating with 68 members from 57 countries, TGS is a credible alternative to the Big4 and has sustainability at the heart of everything they do. TGS are committed to implementing responsible business practices and developing global VAT solutions with a positive impact on society.

Andrew Tucker has had a variety of roles at HMRC and is currently Head of Northern Ireland Protocol VAT Policy. He is a certified leadership coach, a sought after speaker on a variety of topics, and lectures at St Mary’s University on leadership in the 21st century. In his spare time, he is a trustee for two education charities, coaches football at his daughter’s school and (at the time of writing) is currently training for a half-ironman. He is married to Jane with two daughters, Hannah (10) and Sophie (8).

Since May 2014, Belén is the managing partner of bln palao abogados, S.L.P., a Spanish boutique law firm based in Madrid and focused in Customs, VAT, excise duties and energy/ environmental taxes for national and international clients. Before that, she has worked for more than 14 years for international law firms based in Spain, such as KPMG, Cuatrecasas and Deloitte where, in 2005, she was appointed as head of the Customs and excise duties practice, within the Spanish Indirect Tax group.

With more than 21 years of experience, she has been recognized awarded by the International Tax Review as one of the best indirect tax advisors (June 2012 to June 2021) and as one of the most important women in tax in Spain, from 2015 to date, rated as “Highly Regarded”. Besides she has listed by Best Lawyers Spain as from 2020 onwards in Tax and Energy Law.

Together with its business activity, Belén is a usual lecturer for VAT, customs and energy taxation in public universities (UCM, UC3M, UPV) and private institutions (ISDE, Enerclub, UEM). She also coordinates a specific course dealing with Customs Law organized by the Escuela de Práctica Jurídica, belonging to the Universidad Complutense de Madrid.

David Hummel is since October 2016 legal secretary (référendaire) at the European Court of Justice at the cabinet of advocate general Kokott.

Before (2013 – 2016) he represented several tax law chairs at the Universities of Münster, Trier, Leipzig and Hamburg. In mid-2017 the appointment as a Professor at the University of Leipzig took place. His academic career starts with the Study of Law at the University of Leipzig, a Graduation (Phd) as an assistant of Prof. Dr. Stadie with a VAT-Thesis in 2009 and a Habilitation in 2013 with the matter: „Rechtsformneutralität im Öffentlichen Recht“ (neutrality of legal forms in public law – venia legendi: public law, especially tax law and public economic law).

David Hummel is one of the authors of, inter alia, „Rau/Dürrwächter“ (commentary of the VAT-Law), „Kirchhof/Söhn/Mellinghoff“ (commentary of the income tax law) and “Hübschmann/Hepp/Spitaler” (commentary of the procedure tax law). Furthermore, he is engaged as a tutor in the field of European Tax Law and State Aid Law.