Taxable persons who wish to carry out a zero-rated (exempt with credit) intra-Community supply of goods must provide proof thereof. Basically, the proof has to be …

Taxable persons who wish to carry out a zero-rated (exempt with credit) intra-Community supply of goods must provide proof thereof. Basically, the proof has to be formal in nature, specifically documentary and accounting evidence. In the Federal Fiscal Court’s view (judgment of 19 March 2015 – V R 14/14) evidence provided by a witness is accepted only in exceptional cases. Above all, this decision will have an impact on legal disputes.

1. Problem

According to sec 4 No 1(b), in conjunction with sec 6a para 1 of the German VAT Act, intra-Community supplies are zero-rated. In accordance with sec 6a para 3 of the German VAT Act, in conjunction with sec 17a, sec 17c of the VAT Implementation Code, it is necessary to always have available formal documentary and accounting evidence of a supply. According to consistent case law, it is possible to provide and complete such documentary proof up until the end of oral proceedings before the fiscal court. However, the zero-rating will also have to be granted if it is established that the material requirements of the VAT exemption rules have been met (= objective proof).

2. Facts

In the relevant years, from 2001 to 2004, the claimant operated a wholesale trade in household articles, special items and photographic articles. The claimant indicated that, in the course of these said years, he had supplied goods to a recipient in Italy. The goods had been partly transported by the claimant himself and partly by the recipient. The claimant treated these supplies as being zero-rated. He provided proof of an intra-Community supply by means of international consignment notes and CMRs. He also provided a subsequent confirmation by the recipient. In a meeting where the case was discussed, the managing director of the recipient reconfirmed that the supplies had been properly carried out. The defendant tax office denied the zero-rating. The tax office was of the opinion that the proof of intra-Community supplies provided was incomplete. In addition, the claimant was found to have merely simulated the supply chain. This was also confirmed by the claimant’s commercial accountant, in the course of the preliminary proceedings. The Fiscal Court in Düsseldorf denied the zero-rating.

3. Statements of the Federal Fiscal Court

The claimant’s appeal was denied by the Federal Fiscal Court. The Court denied the zero-rated intra-Community supply after finding that the required documentary proof was incomplete. According to the Court, the place of destination had not been correctly indicated. The Federal Fiscal Court ignored the question of whether, in this case, consignment notes would actually be the correct form of documentary proof after all. Whether the goods have physically left Germany is to be checked on the basis of the documents which the taxable person is required to have available. The member states would be entitled to lay down these formal criteria. European Union law would also demand VAT exemption, even in cases where the requirements for VAT exemption are indisputably met, notwithstanding the existence of these formal criteria. However, this is not the case here. The taxable person is basically not entitled to provide proof other than through documentary and accounting evidence. Evidence by witnesses is therefore essentially ruled out. This would be different only if, in exceptional cases, “it was not possible or unreasonable to provide the formal evidence.” The Federal Fiscal Court leaves unanswered the question of in what circumstances this sort of case would arise.

4. Effects of this decision

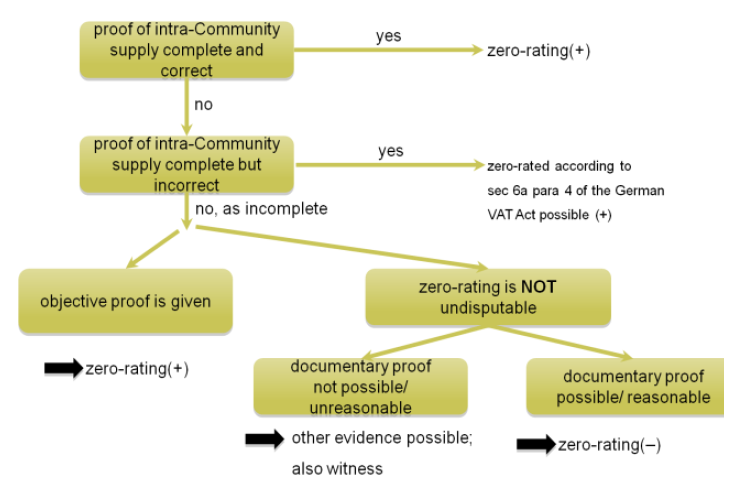

If, based on this decision, all possibilities to provide proof of an intra-Community supply are taken into consideration, the following overall picture arises

The following consequences for legal practitioners arise: If the supplying taxable person wishes to benefit from the zero-rating, he has to take strict care to ensure that he is in a position to provide all necessary formal proof. If he subsequently becomes aware that documentary proof is incorrect or incomplete, he should immediately take steps to remedy this situation. Providing evidence from witnesses, with the intention of compensating for some defect in the documentary proof is, according to the Federal Fiscal Court’s decision, basically ruled out.

If a taxable person intends to provide the necessary proof for a zero-rated supply by means of evidence from a witness, he also has to be able to prove that he is not able to or it would be unreasonable to provide the documentary proof. Otherwise, he runs the risk that his application will be rejected.

5. Conclusion

In the Federal Fiscal Court’s case, there were apparently contradictory testimonies from witnesses. This aspect was, however, not considered to be important by the Federal Fiscal Court. The Court simply made a general statement to the effect that such evidence from witnesses could only be used to prove an intra-Community supply in exceptional cases.

As a result, two core issues arise: What remains from the objective proof in practice if, for example, the witnesses consistently confirm that the goods had been transported elsewhere in the Community? In what circumstances is it deemed to be not possible or unreasonable to provide the necessary documentary proof? Taxable persons seeking to minimize risk will have to take care to have available the necessary proof of supply.

Thomas Streit

Küffner Maunz Langer Zugmaier