There are two aspects to this measure. The first part makes changes to the existing rules which allow HM Revenue and Customs (HMRC) to direct an overseas business to appoint a VAT representative with j…

Representatives for overseas businesses and joint and several liability for online marketplaces

Who is likely to be affected?

Overseas businesses selling goods to UK consumers via online marketplaces and businesses that control and support the sale of such goods through their online marketplaces.

General description of the measure

There are two aspects to this measure. The first part makes changes to the existing rules which allow HM Revenue and Customs (HMRC) to direct an overseas business to appoint a VAT representative with joint and several liability. The changes make this a more effective power and also give HMRC greater flexibility in respect of seeking a security. The second part is the introduction of a new provision which will enable HMRC to hold an online marketplace jointly and severally liable for the unpaid VAT of an overseas business that sells goods in the UK via that online marketplace. Neither of these changes will apply automatically to any businesses and HMRC will use them on the highest risk cases to tackle non-compliance.

Policy objective

The government is taking action to protect the UK market from unfair online competition. The objective of this measure is to give HMRC strengthened operational powers to tackle the non-compliance from some overseas businesses that avoid paying UK VAT on sales of goods made to UK consumers via online marketplaces. It is directed at getting overseas businesses that are or should be VAT registered in the UK paying VAT due either directly or through a VAT representative. If the overseas businesses continues to be non-compliant, HMRC can make the online marketplace jointly and severally liable for the unpaid VAT on goods sold through its online marketplace. The measure will level the playing field for businesses.

Background to the measure: There has been no prior consultation on this measure.

Operative date: The measure will have effect from Royal Assent to Finance Bill 2016.

Current law: Current law in Section 48 of VAT Act 1994 (VATA) gives HMRC the power to direct a ‘person’ to appoint a VAT representative, with joint and several liability, where the ‘person’ is not established in the UK and/or another EU Member State.

Proposed revisions

VAT representatives: The government will legislate in Finance Bill 2016 to amend Section 48 of VATA1994 to provide HMRC with strengthened powers for directing the appointment of a VAT representative. This will include a requirement that the VAT representative is in the UK and will also provide more flexibility in respect of seeking a security.

Joint and several liability on the online marketplaces: New legislation will be introduced in Finance Bill 2016 to enable HMRC to hold an online marketplace jointly and severally liable for the unpaid VAT of an overseas business that sells goods in the UK via the online marketplace’s website.

Summary of impacts:

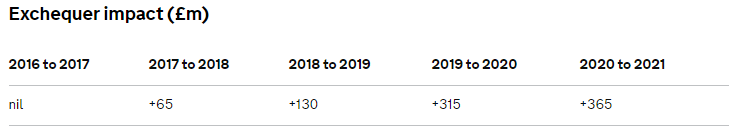

These figures are set out in Table 2.1 of Budget 2016 as ‘Value Added Tax: tackling overseas trader evasion’ and have been certified by the Office for Budget Responsibility. They represent the combined Exchequer impact of the new HMRC powers to deal with overseas businesses and the new Due Diligence Scheme.

The amount of VAT revenue forgone on such under-declarations is estimated to be £1-1.5 billion in 2015 to 2016. This estimate has been derived from UK import data, supplemented with operational and other intelligence to identify high risk imports, the proportion of goods undervalued, and the extent of the undervaluation. More details can be found in the policy costings document published alongside Budget 2016.

Economic impact: The proposal to provide HMRC with additional powers for directing the appointment of a VAT Representative and greater flexibility in respect of seeking security may have a very small positive impact on inflation.

The costing accounts for a behavioural response whereby some non-EU online sellers or fulfilment houses may find ways to mitigate the impact of this measure.

Impact on individuals, households and families: This is a VAT compliance measure, and could result in a minor increase in inflation which would increase prices. It is expected to have a negligible impact on individuals, households and families, and is not expected to impact on family formation, stability or breakdown.

Equalities impacts: The measures are only aimed at non-compliant overseas sellers. It will not disadvantage sellers who are operating legitimately.

Impact on business including civil society organisations: This measure will level the playing field for businesses. This measure is expected to have a negligible impact on businesses. The online marketplace population is small, with a few major players and HMRC understands that these businesses already have existing processes in place for the removal of sellers that break the rules of the marketplace. Affected businesses will incur one-off costs of familiarisation with the new rules. Any ongoing additional costs are expected to be minimal. This measure is not expected to have any impact on civil society organisations.

Operational impact (£m) (HMRC or other): HMRC will incur one-off capital costs of approximately £700,000 and resource costs of approximately £22.5 million between 2016 to 2017 and 2020 to 2021.

Other impacts: Other impacts have been considered and none have been identified.

Monitoring and evaluation: This measure will be kept under review through communication with affected taxpayer groups.

Steve Botham

Covertax Chartered Tax Advisers