If the tax office denies a recipient his input VAT deduction, the recipient, under certain conditions, is granted a direct claim (= so-called Reemtsma claim) against the tax office. Shortly after the Federal Ministry of Finance’s letter, the Fiscal Court of Münster referred a related question to the ECJ (decision of 27 June 2022 – 15 K 2327/20 AO; Schütte – C-453/22). It asked the ECJ to clarify some important questions of application. In essence, this concerns the relationship between the supplier’s VAT adjustment procedure of the unduly charged VAT and the recipient’s Reemtsma claim. It should also be clarified to what extent the beneficiary must take civil action as a matter of priority.

- Background

For more than 15 years now, the ECJ has assumed that a recipient is granted a direct claim – a Reemtsma claim – against the tax authorities if he has overpaid VAT to a supplier but does not receive a refund from the supplier or if the refund is excessively difficult to obtain (ECJ, judgment of 15 March 2007 – C-35/05 – Reemtsma Cigarettenfabriken). In its letter of 12 April 2022, the Federal Ministry of Finance stated, for the first time, its opinion on how a Reemtsma claim should be applied. It identified several preclusion criteria: Any contributory negligence on the part of the recipient is considered to be harmful. The VAT refund claim under civil law shall only be deemed impossible if the supplier’s application for insolvency proceedings has been rejected due to the value of the debtor’s assets being inadequate to cover the costs of the insolvency proceedings. The claim is precluded as long as an adjustment of the unduly charged VAT amount in accordance with sec 14c of the German VAT Act is still possible for the supplier. If the civil law claim against the supplier can no longer be enforced because it is time-barred, then the direct claim must also be excluded, because it follows the civil law claim. This is where the Fiscal Court of Münster’s case comes into play (decision of 27 June 2022 – 15 K 2327/20 AO; Schütte – C-453/22).

- Facts

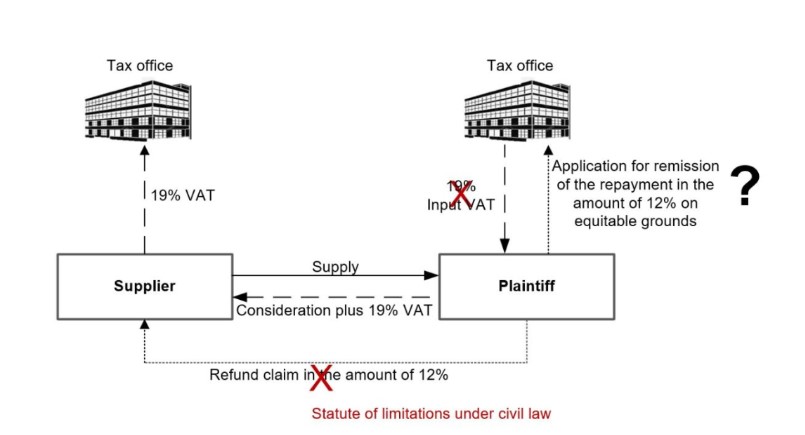

The plaintiff is engaged in the commercial timber trade. His activities include both the purchase and reselling of timber. His suppliers issued invoices showing 19% VAT and paid it to the tax office. The plaintiff paid the net amount plus 19% VAT to his suppliers and deducted the input VAT. Following an audit, the tax office denied the plaintiff’s input VAT deduction in the amount of the difference between the standard and reduced VAT rate (12%), because the purchases were subject to the reduced VAT rate of 7%. The plaintiff requested that his suppliers correct their invoices and pay him the difference. The suppliers refused to do so and invoked the statute of limitations under civil law. The plaintiff subsequently filed an application with the tax office for remission of the VAT repayment obligation in the amount of 12%, as well as the interest accrued thereon, on equitable grounds. The tax office rejected this application.

- Considerations of the Fiscal Court of Münster

The Fiscal Court of Münster addressed the ECJ by way of reference for a preliminary ruling. Even though it ultimately only referred one specific question, it essentially asked the ECJ three things:

- Can the recipient claim a Reemtsma claim even if the supplier is still able to adjust the invoices in accordance with sec. 14c of the German VAT Act? Here, the Fiscal Court of Münster foresees a risk that the tax authorities could potentially, and to their obvious detriment, reimburse the VAT twice.

- Can the expiration of the statute of limitations preclude the recipient’s use of the Reemtsma claim against the supplier under civil law? In the Fiscal Court’s view, the recipient should have taken precautions to secure its claims by obtaining a waiver from the supplier regarding the supplier’s right to invoke the statute of limitation.

- Does the Reemtsma claim also include interest? The court assumes that no interest has accrued prior to the assertion of the Reemtsma claim.

- Consequences for the practice

The Fiscal Court of Münster raises questions as to the application of the Reemtsma claim that have not yet been clarified in the jurisprudence of the Federal Fiscal Court. The ECJ has so far only ruled on cases in which the supplier was insolvent. However, since the recipient cannot enforce his claim against the supplier, even in the instance of a statute of limitations case under civil law, the Reemtsma claim should also be applied in these cases. To date, the ECJ has not expressed the view that the Reemtsma claim could be restricted: It neither states that the VAT adjustment of unduly charged VAT according to sec. 14c of the German VAT Act (= Art. 203 of the EU VAT Directive), takes precedence over the Reemtsma claim, nor has it established the requirement that the recipient should have taken measures against the supplier to prevent the limitation period from expiring. If the Reemtsma claim served to establish the neutrality of VAT, compensation in the form of interest damages would also be consistent. Until such time as the ECJ decision is available, recipients whose civil law claims are at risk of becoming time-barred could, as a precautionary measure, consider taking steps to prevent the statute of limitations from expiring. Regardless of the outcome of this specific case, the national legislator would do well to regulate the interface between sec. 14c of the German VAT Act, civil law and the Reemtsma claim in a user-friendly manner.

Thee above information was kindly provided by KMLZ (Germany). If you need further information, please contact Dr. Thomas Streit at: [email protected].